Array Ventures (website) is a preseed investor in enterprise companies solving hard problems in AI, Data, Security, Infra, Cloud, and select vertical. Array VC was on the Seed 30 VC list published by Business Insider! Connect with us (arraydeals@array.vc) if you are thinking of starting a B2B data/AI company.

Welcome new investments to the Array Family

Expanso - Distributed data processing

Happyrobot - Vision-Language models for image analysis (current YC S23)

CandorIQ - Compensation and Headcount Planning (current YC S23)

Wokelo - Business Research and Analysis

Portfolio Notable Follow-on Rounds

Release Management for mobile apps company Runway raises $2m from Bedrock Capital

M12 invests in Bytewax to build the future of stream processing

Zingly raises from Scribble Ventures to 3x customer sales pipeline

Blumira announces Series B Funding along with their XDR platform launch

Catch+Release raises Series A for brands to license user-generated content using AI

Vue.ai raises Series C from Avatar Growth to boost their reach into new verticals

*Few others that haven’t been announced yet but you will hear about it soon!*

Job Opportunities at Array’s 54 Portfolio Companies

Our companies are hiring and looking for Engineers (leads and IC’s), Sales, Customer Success, Marketers, Designers and more globally including many remote openings. Check out all the listings here.

Our companies have some fun news as well. See what they have carefully put out there for you:

Wokelo.ai is developing valuable business research tools for investors to run their funds

OpsVerse announces Aiden, a Generative-AI Secure DevOps Copilot

Veteran finance leaders found a company, Precanto, to use AI for real-time headcount planning

Capsule AI's video editor for enterprise launched in private beta with companies like Hubspot, Pinterest, and BCG (watch their cool demo)

Data platform, Mozart Data, announces free tier for startups

Integral launches product to Maximize Dataset Customization and Privacy

Funtivity by Hermis, an engagement and learning platform, was highlighted by Microsoft CEO, Satya Nadella, during his keynote

Eventual Computing launches Daft a high-performance distributed dataframe library for multimodal data

Stronghold Launches StrongholdNET with merchant rewards and DeFi-backed financing

Almanac interviews 5000 business leaders to create “The Modern Work Method,” to help professionals work better

Blendid's Robotic Kiosks at Walmart, Bay Club, and Grady Memorial Hospital Shake Up the Food Industry

Market Observations from a Preseed Investor

Understanding how the startup funding market is doing is on top of everyone’s mind. On a recent panel at ServiceNow I try to give a sense of that to the founders. Shared some of my thoughts on this post. Quick observations are:

VC Funding - While it looks like AI startups are funded easily today that is only true for fresh new preseed startups and not 1-2 years old startups that might be fundraising. Overall venture funding in Q2 was at its lowest quarterly total in more than 3 years. Later stage investors are very picky about what they invest in. While there were investments in some late stage AI startups like Anthropic and Cohere, some recent AI investments Stability AI and Jasper have already been experiencing some trouble in less than a year after some large raises. Majority of the later stage VCs are still waiting to make any big bets with meaningful ownership. What they are doing instead is investing at the seed stage and giving incorrect signals to founders by investing in rounds with high valuations.

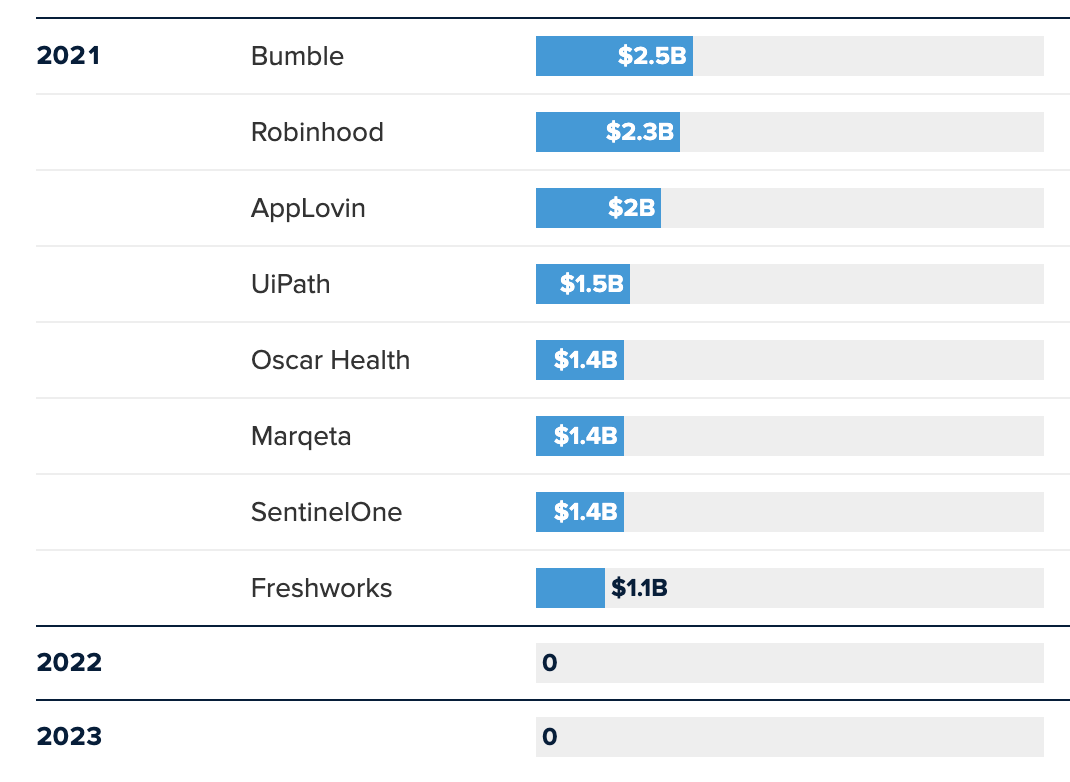

Tech IPOs - There have been no notable tech IPOs since Q4 2021. There was a decent non-tech IPO of Cava. (I had their food last December in DC and I thought it was pretty good!)

M&A - There has been some tech M&A activity of companies such as MosaicML (Databricks for $1.3B), Casetext(Thomson Reuters $600m), and Mode Analytics (Thoughtspot $200m). Although the overall numbers are still low. While many had predicted M&A activity to pick up unfortunately high interest rates makes borrowing for the acquirer too expensive. The sentiment is that companies may not want to acquihire since good talent is available to hire in the market with recent layoffs.

If you made it this far then thank you for reading. You might also enjoy this post on Taylor Swift. I like to hear from you as well. Please feel free to respond with your favorite AI story!

Also, I try to send this newsletter once a quarter. For updates between newsletters follow me on Twitter and LinkedIn. Share this newsletter with your friends or reply with their email to add them to the distribution. Let me know if you find this valuable and any other things you would like to see!